Full disclosure typically means the real estate agent or broker and the seller disclose any property defects and other information that may cause a party to not enter into the deal. Simply put, the full disclosure principle means companies must openly share all important financial information, ensuring transparency and fair representation in their financial statements. Conference calls with the company’s management may be used to clarify the information provided in the reports. The principle helps foster transparency in financial markets and limits the opportunities for potentially fraudulent activities. The importance of the full disclosure principle continues to grow amid the high-profile scandals that involved the manipulation of accounting results and other deceptive practices.

Accrual Basis in Accounting: Definition, Example, Explanation

Such information is made available to stockholders and other what is the debt to asset ratio and how to calculate it users either on the face of financial statements or in the notes to the financial statements. Moreover, full disclosure helps protect you from potential legal disputes and financial losses. By disclosing all relevant information, you minimize the risk of being accused of fraud, misrepresentation, or negligence.

Full Disclosure Requirements

However, despite that fact, all items could have a material impact on the company’s financials and must be disclosed. All content on this website, including dictionary, thesaurus, literature, geography, and other reference data is for informational purposes only. This information should not be considered complete, up to date, and is not intended to be used in place of a visit, consultation, or advice of a legal, medical, or any other professional. In a contract, full disclosure means that both parties must reveal all important details that could affect the agreement.

On the contrary, the rule would be impractical then, as it would dump a huge volume of information on analysts and investors. The principle urges the disclosure of information that can have a material impact on the company’s financial results or financial position. The Full Disclosure Principle states that all relevant and necessary information for the understanding of a company’s financial statements must be included in public company filings. Full disclosure means providing all pertinent information about a product or service.

Full Disclosure Principle: Accounting Meaning, Importance & Examples

Full disclosure ensures that all parties to an agreement have access to complete and accurate information, promoting what are operating activities in a business fairness and transparency. It protects against legal disputes and fosters trust in business relationships. Full disclosure refers to the obligation of a party to reveal all relevant and material information in a transparent and truthful manner, typically during negotiations or in a contractual agreement. This ensures that all parties have a complete understanding of the facts before entering into an agreement or transaction. When everyone shares all necessary information, it helps prevent misunderstandings and disputes later on.

Find a legal form in minutes

It reduces the risk of disputes or legal claims that might arise if hidden or omitted information later comes to light. If someone fails to provide full disclosure, it can lead to serious consequences. The other party may have grounds to cancel the contract, seek damages, or even take legal action. In court cases, withholding information can harm a party’s credibility and case.

Due to SEC regulations, annual reports to stockholders contain certified financial statements, including a two-year audited balance sheet and a three-year audited statement of income and cash flows. The report’s content and form are strictly governed by federal statutes and contain detailed financial and operating information. Management typically provides a narrative response to questions about the company’s operations. Full disclosure also refers to the general need in business transactions for both parties to tell the whole truth about any material issue about the transaction.

- The nature of relationship between the business and related party/parties of the organisation.

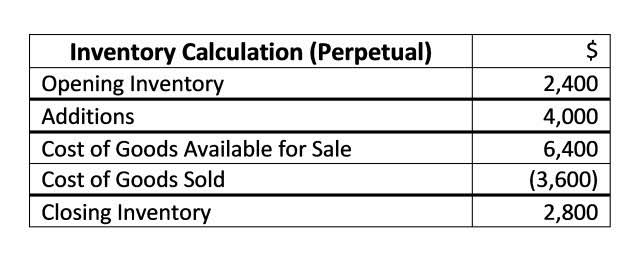

- For instance, a change in inventory valuation method from FIFO to LIFO would be represented in the footnotes.

- There are strict rules for disclosure in almost all jurisdictions, and these have been monitored with the aid of agencies like the SEC (U.S.A.), SEBI (India), and several global accounting boards.

- This helps the judge or jury make a well-informed decision based on all available facts.

Similarly, in patenting, full disclosure is necessary for the patent to remain valid. If an applicant fails to provide complete details of an invention, the patent can be rendered invalid or canceled. The real estate agent or broker and the seller must be truthful and forthcoming about all material issues before completing the transaction. If one or both parties falsifies or fails to disclose important information, that party may be charged with perjury. The information is disclosed in the regulatory filings (e.g., SEC filings) that a public company must submit. The most important filings include the company’s quarterly and annual reports, which contain audited financial statements, various notes and schedules to the statements, as well as descriptive guidance from the management.

In order to help you advance your career, CFI has compiled many resources to assist you along the path. For example, many courts enforce a requirement on the parties signinga prenuptial agreement that there is full disclosure regarding the assetsof bothparties. Often, a schedule of assets will be attached to an incorporated inot a prenuptial agreement to prove full disclosure was madeand the agreement was signed knowingly and free from deceit. Browse US Legal Forms’ largest database of 85k state and industry-specific legal forms. The legal term ‘for’ is used to indicate the reason or purpose behind an action, similar to saying ‘because of’ in everyday language. Additional disclosures may also be required for related party balances, guarantees, and commitments.

This information may include the terms of a contract, potential risks involved, or any other information that may influence the decision making of the buyer. Providers of goods or services have a legal and ethical obligation to make full disclosure to their customers. This is to ensure that the lack of information does not mislead the users of financial information. The idea behind the full disclosure principle is that management might try not to disclose any information that could impair the entity’s financial statements and its reputation as a whole. Securities and Exchange Commission’s (SEC) requirement that publicly traded companies release and provide for the free exchange of all material facts that are relevant to their ongoing business operations.

Failure to adhere to full disclosure can lead to investor mistrust, potential legal issues, and a damaged reputation. Footnotes provide more detail on accounting policy, risk exposures, and assumptions that underlie financial figures, thus enhancing transparency. The Generally Accepted Accounting Principles (GAAP) in the U.S. mandate full disclosure of all pertinent information, financial or operating, pending litigation, regulatory fines, and disruptions to operations. GAAP dictates the rules for severe compliance via specific formats and guidance. From both intent or carelessness, omitting material facts to a greater or lesser extent may lead to lawsuits or governmental action. Even minor transgressions can be construed as misrepresentation in compliance-minded markets.

Management Discussion and Analysis (MD&A)

However, it is generally a good practice to be open and honest to avoid potential issues down the line. Full Disclosure Principle simply means disclosing all information required by an accounting standard, and the best way to check this is going to the specific standard. If your Financial Statements use IFRS, IAS 1 Presentation of Financial Statement should be applied. Here is the general disclosure that the financial statements of an entity are required to have. Remember, full disclosure is just the principle to help an entity, especially an accountant, prepare and present financial statements. In doing so, the financial statements still look good and healthy so that all of the stakeholders are still happy about the company.

The full disclosure principle requires the entity to disclose both Financial Related irs receipts requirements Information and No Financial Information Related. Under the principle of full disclosure, businesses are also required to report their accounting policies in practice and anytime those policies change. Usually, companies are given the right to only disclose financial information and related material that actually could have an effect on the financial state of the company. In Accounting, this is the practice of disclosing all material facts truthfully and completely to avoid any misunderstanding. In Patenting, this is the disclosure of all material facts to avoid any deviation that may render the patent null and void in the patent application. Notes to accounts provide detailed explanations and supplementary information that cannot be easily presented in the main financial statements.

The financial statements of a company are primarily prepared for the use of its stockholders. This allows them to look after the activities of management and make sure that their company is running profitably. But it is also a fact that shareholders are not the only party of interest that relies on these financial statements. Stakeholders like suppliers, customers, lenders, potential investors, etc. also use these financial statements to feed their individual information needs. These external stakeholders analyze and interpret these financial statements to make informed and detailed decisions.

Legal glossary

- Once the users of Financial Statements note this information, they will understand the entity’s current contingent liabilities.

- While both are important, materiality focuses on disclosing only information significant enough to influence decisions.

- In court cases, withholding information can harm a party’s credibility and case.

- Due to SEC regulations, annual reports to stockholders contain certified financial statements, including a two-year audited balance sheet and a three-year audited statement of income and cash flows.

- Since, the external users of financial information lack any kind of information on how business is run, the full disclosure principle makes it easier to determine how a company is functioning.

When a lot of the report has pages full of technical details, stakeholders will be confused about what is materially significant. Causing fatigue in information and paralysis in decision-making would, at least, be prevalent among small investors. Operational risks, such as everything from supply chain instability to cyberattacks and threats from the industry (market volatility), will have to be included. Geopolitical risks, legal challenges, and regulatory uncertainties will be covered. Risks of this type certainly complete the picture to ensure that investors do not wake up one morning and find a value eroded suddenly by unanticipated risks.

In summary, the full disclosure principle is a core idea in accounting that ensures all relevant financial information is shared for clear decision-making. It is essential for exam performance, business transparency, and legal compliance. At Vedantu, we simplify such commerce concepts to help students excel in school, college, and career. It is a requirement that the whole truth mustbe told before a purchase is made or a contract is signed, so that thepurchaser or signer is fully informed about the consequences of his/herdecision.

Well, basically, to ensure that whether the entity complies with the full disclosure principle or not, the entity should go to the standard that they are following. For example, the company is facing a lawsuit resulting from disposing of poison material into the water, and it will be a large penalty. In such a case, management probably doesn’t want outsiders, especially investors, to know the real situation of an entity. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.